Metal Or Asphalt Roofs With Qualified Coatings Tax Deduction

Furthermore the tax credit does not cover labor costs.

Metal or asphalt roofs with qualified coatings tax deduction. But in order to qualify your new roof must include certified metal or asphalt with pigmented coatings or cooling granules that are specifically designed to reduce heat gain within the home. If the roof was installed in 2016 you can amend your 2016 return to include the expense. You can claim back 10 of the cost up to a maximum of 500. However your total credit cannot exceed the lifetime limit of 500 for all tax years after 2005.

If your roof meets energy star standards your roof will reflect more of the sun and reduce surface temperatures by up to 100 f. Learn more and find products. Check with your local roofing contractor to see if your metal roof qualifies for the energy tax credit. Asphalt and metal roofs.

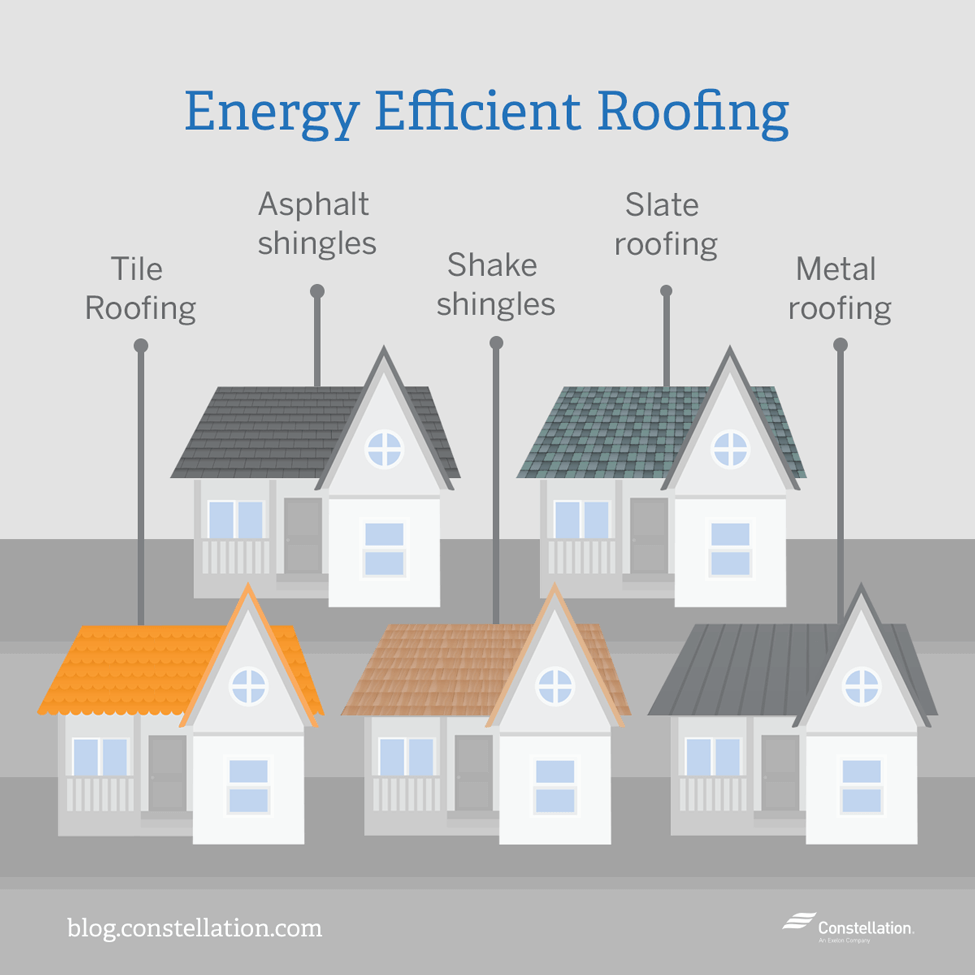

You may claim a tax credit of 10 of cost of the qualified roofing product. The cost of installation is not included in the tax credit calculation. There are two types of new roofs that qualify for tax credits. Metal roofing and asphalt shingles with cooling granules.

The tax credit is redeemable by homeowners who have installed cool roofing materials. Metal roofs with pigmented coatings and asphalt roofs with cooling granules will qualify for this. This tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain. Metal roofs with appropriate pigmented coatings or asphalt roof with appropriate cooling granules specifically designed to reduce the heat loss or gain of your home could qualify for the credit.

Form 5695 specifically states that metal or asphalt roofs must meet or exceed the energy star program requirements and have appropriate pigmented coatings or cooling granules that are specifically. However roofs with solar panels and solar shingles may qualify in the near future as they become more affordable and available. This tax credit amounts to 10 of the total cost. The two main types of eligible roofing materials are metal roofs with pigmented coating and asphalt roofs with cooling granules.

Only certain roofing materials qualify for tax credits. These materials must also meet other energy star requirements and it is best to check these requirements when choosing materials. 2 asphalt roofing made with cooling granules also qualifies for a tax deduction.